Continuous positive airway pressure therapy

Table of Contents

Table of Contents

Continuous Positive Airway Pressure (CPAP) therapy is a highly effective treatment option for obstructive sleep apnea (OSA). However, one big question for many people is whether their insurance will cover the cost of CPAP therapy. In this blog post, we will explore the topic of Continuous positive airway pressure therapy insurance coverage and provide insights into the benefits, the requirements, and some of the challenges patients may face when trying to obtain coverage.

Understanding the Pain Points for CPAP Coverage

For individuals who suffer from sleep apnea, getting the therapy they need can be a challenge. One of the most significant pain points is the high cost of CPAP equipment and supplies, which may not be covered by insurance. Some insurance plans may require prior authorization, and patients may need to provide documentation that proves medical necessity for this treatment. In some cases, insurers may look for cheaper options, such as mandibular advancement devices (MADs), instead of CPAP, which may not be as effective for treating severe OSA. Additionally, patients may be required to use certain Durable Medical Equipment companies (DME), which may not always be convenient or offer the best equipment options.

What is the Target of CPAP Insurance Coverage?

The target of CPAP therapy insurance coverage is to provide financial support to patients who require CPAP therapy to manage their sleep apnea. The goal is to make this essential therapy accessible to all patients who need it regardless of their financial status. Insurance coverage can help to offset the costs of CPAP equipment and related supplies and may also cover other expenses such as replacement parts, repairs, and maintenance.

Main Points on CPAP Insurance Coverage

Continuous positive airway pressure therapy insurance coverage can be the key to accessing the quality equipment and supplies needed to treat sleep apnea. Patients must understand their insurance policy’s requirements and limitations to get the best benefits from their coverage. It is essential to research the insurance policy options to determine what coverage might be available and if the coverage is adequate for their needs. Patients may need to provide documentation that supports medical necessity. It is also important to consider that different insurance policies will have various procedures, copays, deductibles, and network requirements.

Personal Experience with CPAP Insurance Coverage

As someone who has suffered from sleep apnea, I understand the importance of CPAP therapy and how it can transform a person’s life. Like many others, I was concerned about how to pay for this essential therapy. However, with proper research and speaking with my doctor, I was able to find a policy that covered CPAP therapy. The process required some patience, time, and paperwork, but it was worth it in the end. I was able to access the equipment and supplies I needed to manage my condition and get a good night’s sleep.

Challenges with CPAP Insurance Coverage

While CPAP insurance coverage is incredibly beneficial for many individuals, some factors can make it challenging to obtain coverage. First and foremost, every insurance policy is different, and patients must research to understand their coverage options. Some policies may require patients to visit specific DME providers, which may limit their options regarding equipment selection. The approval process can also be time-consuming and require a lot of paperwork. Additionally, some insurance companies may have coverage limitations, such as a cap on the number of supplies covered or the frequency at which those supplies may be replaced.

The benefits of CPAP Insurance

The primary benefit of CPAP insurance is financial support for patients who require this treatment. Insurance can help to offset medical expenses related to the diagnosis and management of sleep apnea. Additionally, insurance can offer peace of mind for patients, knowing they have a treatment option available to them without incurring high out-of-pocket expenses. Finally, insurance can lead to better health outcomes, as patients who have access to therapy are more likely to be compliant with treatment, leading to better management of their sleep apnea.

Limitations of CPAP Insurance

While CPAP insurance coverage can be incredibly beneficial, there are some limitations to consider. For example, some policies may only cover specific types of machines or may have limitations on the frequency of supply replacements. Additionally, patients may need to visit specific providers or use specific equipment brands, limiting their options. It is also important to consider that copays and deductibles will still apply, meaning patients may have some out-of-pocket expenses associated with their CPAP treatment.

Question and Answer Section:

Question 1: What documentation is required for CPAP insurance coverage?

Answer: Patients may need to provide documentation from their physician that explains their diagnosis and the medical necessity for CPAP therapy. They may also need to provide documentation that shows they have met their policy’s deductible.

Question 2: Will insurance cover all CPAP equipment?

Answer: Insurance coverage can vary, but most policies will cover the essential CPAP equipment and supplies. It is important to review the policy and speak with the insurer to determine what is covered and what may not be covered.

Question 3: Can I choose any DME provider I want?

Answer: It depends on the policy. Some policies require that patients only use specific providers, while others may allow patients to choose their provider.

Question 4: How do I know if I have insurance coverage for CPAP therapy?

Answer: Patients should review their insurance policy or speak with their insurer to determine if they have CPAP coverage.

Conclusion of Continuous Positive Airway Pressure Therapy Insurance Coverage

CPAP insurance coverage is an essential part of accessing the therapy needed to treat sleep apnea. While it may have some limitations, understanding one’s insurance policy is vital to maximizing benefits and getting the best possible care. By working with one’s physician and insurer, patients can find the right policy to meet their needs and get the equipment and supplies required to manage their condition effectively.

Gallery

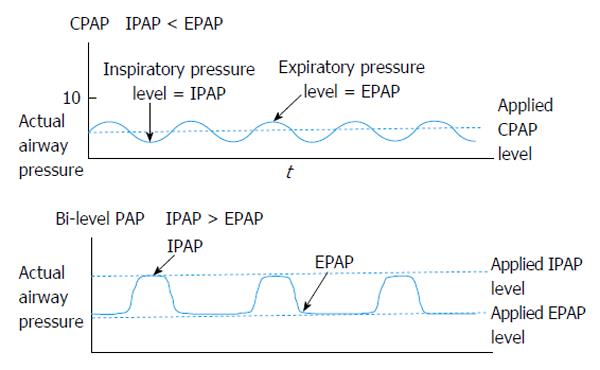

Positive Airway Pressure Therapy For Heart Failure

Photo Credit by: bing.com / pressure airway positive continuous bi level therapy 1175 wjc heart failure v6 i11

Continuous Positive Airway Pressure Therapy | Nursing Information

Photo Credit by: bing.com / pressure continuous positive airway therapy

Mechanism Of Action Of Continuous Positive Airway Pressure Therapy IV

Photo Credit by: bing.com / airway pressure positive continuous therapy iv

Different Types Of Positive Airway Pressure Devices

Photo Credit by: bing.com / pressure positive airway continuous cpap devices types machine breathing market bipap different

Continuous Positive Airway Pressure [37]. (Internet, Google Images

![Continuous positive airway pressure [37]. (Internet, Google images Continuous positive airway pressure [37]. (Internet, Google images](https://www.researchgate.net/profile/Mohammed_Jaradat4/publication/281926605/figure/fig2/AS:668370873643016@1536363442451/Continuous-positive-airway-pressure-37-Internet-Google-images-CPAP-first-page-PAP.png)

Photo Credit by: bing.com / airway continuous cpap pap